Warning

This page was created from a pull request (#70).

Portfolio selection

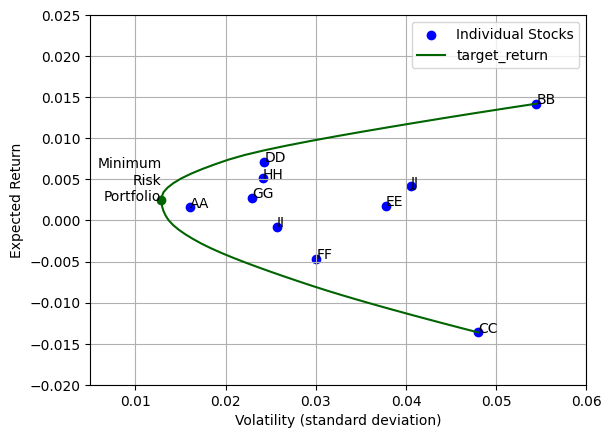

Given a sum of money to invest, one must decide how to spend it amongst a portfolio of financial securities. Our approach is due to Markowitz (1959) and looks to minimize the risk associated with the investment while realizing a target expected return. By varying the target, one can compute an ‘efficient frontier’, which defines the optimal portfolio for a given expected return.

Adapted from the Gurobi examples. This does not illustrate the accessor API since all constraints are single expressions.

Point to think about though: when we do construct a single expression by applying pandas operations to series, the user has to fall back onto gurobipy methods.

[1]:

import gurobipy as gp

from gurobipy import GRB

from math import sqrt

import gurobipy_pandas as gppd

import pandas as pd

import numpy as np

import matplotlib

import matplotlib.pyplot as plt

Import (normalized) historical return data using pandas

[2]:

data = pd.read_csv('data/portfolio.csv', index_col=0)

Create a new model and add a variable for each stock. The columns in our dataframe correspond to stocks, so the columns can be used directly (as a pandas index) to construct the necessary variable.

[3]:

model = gp.Model('Portfolio')

stocks = gppd.add_vars(model, data.columns, name="Stock")

model.update()

stocks

Restricted license - for non-production use only - expires 2025-11-24

[3]:

AA <gurobi.Var Stock[AA]>

BB <gurobi.Var Stock[BB]>

CC <gurobi.Var Stock[CC]>

DD <gurobi.Var Stock[DD]>

EE <gurobi.Var Stock[EE]>

FF <gurobi.Var Stock[FF]>

GG <gurobi.Var Stock[GG]>

HH <gurobi.Var Stock[HH]>

II <gurobi.Var Stock[II]>

JJ <gurobi.Var Stock[JJ]>

Name: Stock, dtype: object

Objective is to minimize risk (squared). This is modeled using the covariance matrix, which measures the historical correlation between stocks.

[4]:

sigma = data.cov()

portfolio_risk = sigma.dot(stocks).dot(stocks)

model.setObjective(portfolio_risk, GRB.MINIMIZE)

Fix budget with a constraint. For summation over series, we get back just a single expression, so this constraint is added directly to the model (not through the accessors).

[5]:

model.addConstr(stocks.sum() == 1, name='budget');

Optimize model to find the minimum risk portfolio.

[6]:

model.optimize()

Gurobi Optimizer version 11.0.0 build v11.0.0rc2 (linux64 - "Ubuntu 20.04.6 LTS")

CPU model: Intel(R) Xeon(R) Platinum 8259CL CPU @ 2.50GHz, instruction set [SSE2|AVX|AVX2|AVX512]

Thread count: 1 physical cores, 2 logical processors, using up to 2 threads

Optimize a model with 1 rows, 10 columns and 10 nonzeros

Model fingerprint: 0x9181cbde

Model has 55 quadratic objective terms

Coefficient statistics:

Matrix range [1e+00, 1e+00]

Objective range [0e+00, 0e+00]

QObjective range [3e-05, 7e-03]

Bounds range [0e+00, 0e+00]

RHS range [1e+00, 1e+00]

Presolve time: 0.01s

Presolved: 1 rows, 10 columns, 10 nonzeros

Presolved model has 55 quadratic objective terms

Ordering time: 0.00s

Barrier statistics:

Free vars : 9

AA' NZ : 4.500e+01

Factor NZ : 5.500e+01

Factor Ops : 3.850e+02 (less than 1 second per iteration)

Threads : 1

Objective Residual

Iter Primal Dual Primal Dual Compl Time

0 4.16767507e+03 -4.16767507e+03 1.00e+04 8.08e-06 1.00e+06 0s

1 4.45599962e-03 -7.80471122e+00 1.09e+01 8.83e-09 1.14e+03 0s

2 4.17460816e-04 -7.14114851e+00 1.09e-05 8.84e-15 4.57e+01 0s

3 4.17365279e-04 -7.33725047e-03 9.40e-10 2.78e-17 4.96e-02 0s

4 3.50058972e-04 -1.09469258e-04 2.26e-11 1.39e-17 2.94e-03 0s

5 1.95819453e-04 5.77538068e-05 2.22e-16 2.69e-17 8.84e-04 0s

6 1.72155801e-04 1.57430436e-04 5.55e-17 6.94e-18 9.42e-05 0s

7 1.66577780e-04 1.65061129e-04 6.66e-16 1.57e-17 9.71e-06 0s

8 1.65913497e-04 1.65828685e-04 1.67e-16 1.39e-17 5.43e-07 0s

9 1.65877870e-04 1.65873375e-04 5.41e-16 1.85e-18 2.88e-08 0s

10 1.65877097e-04 1.65877052e-04 3.39e-15 1.39e-17 2.88e-10 0s

Barrier solved model in 10 iterations and 0.03 seconds (0.00 work units)

Optimal objective 1.65877097e-04

Display the minimum risk portfolio.

[7]:

stocks.gppd.X.round(3)

[7]:

AA 0.468

BB 0.000

CC 0.003

DD 0.125

EE 0.000

FF 0.033

GG 0.017

HH 0.205

II 0.149

JJ 0.000

Name: Stock, dtype: float64

Key metrics

[8]:

minrisk_volatility = sqrt(portfolio_risk.getValue())

print('\nVolatility = %g' % minrisk_volatility)

stock_return = data.mean()

portfolio_return = stock_return.dot(stocks)

minrisk_return = portfolio_return.getValue()

print('Expected Return = %g' % minrisk_return)

Volatility = 0.0128793

Expected Return = 0.00243537

Solve for the efficient frontier by varying the target return (sampling).

One useful point here could be the ability to specify scenarios by mapping onto constraints

[9]:

scenarios = pd.DataFrame(dict(target_return=np.linspace(stock_return.min(), stock_return.max())))

target_return = model.addConstr(portfolio_return == minrisk_return, 'target_return')

model.update()

model.NumScenarios = len(scenarios)

for row in scenarios.itertuples():

model.Params.ScenarioNumber = row.Index

target_return.ScenNRHS = row.target_return

model.Params.OutputFlag = 0

model.optimize()

results = []

for row in scenarios.itertuples():

model.Params.ScenarioNumber = row.Index

results.append(model.ScenNObjVal)

scenarios = scenarios.assign(ObjVal=pd.Series(results, index=scenarios.index))

scenarios['volatility'] = scenarios['ObjVal'].apply(sqrt)

scenarios.head()

[9]:

| target_return | ObjVal | volatility | |

|---|---|---|---|

| 0 | -0.013629 | 0.002303 | 0.047985 |

| 1 | -0.013061 | 0.002114 | 0.045981 |

| 2 | -0.012492 | 0.001937 | 0.044008 |

| 3 | -0.011924 | 0.001769 | 0.042059 |

| 4 | -0.011356 | 0.001611 | 0.040140 |

[10]:

# Plot volatility versus expected return for individual stocks

stock_volatility = data.std()

ax = plt.gca()

ax.scatter(x=stock_volatility, y=stock_return,

color='Blue', label='Individual Stocks')

for i, stock in enumerate(stocks.index):

ax.annotate(stock, (stock_volatility[i], stock_return[i]))

# Plot volatility versus expected return for minimum risk portfolio

ax.scatter(x=minrisk_volatility, y=minrisk_return, color='DarkGreen')

ax.annotate('Minimum\nRisk\nPortfolio', (minrisk_volatility, minrisk_return),

horizontalalignment='right')

# Plot efficient frontier

scenarios.plot.line(x='volatility', y='target_return', ax=ax, color='DarkGreen')

# Format and display the final plot

ax.axis([0.005, 0.06, -0.02, 0.025])

ax.set_xlabel('Volatility (standard deviation)')

ax.set_ylabel('Expected Return')

ax.legend()

ax.grid()